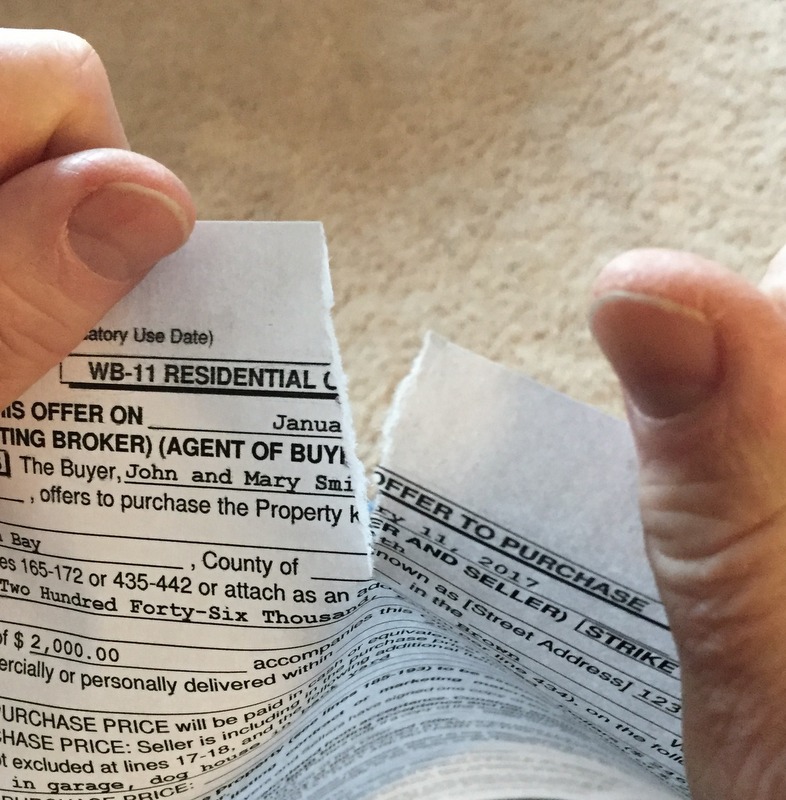

Reader Question: We are considering upgrading to another home. We had a few glitches when we bought our current house. We want to avoid bumps in the road this time, so we are doing some homework to get up to speed. In our state the listing and the offer to purchase contracts combined incorporate 792 lines, not including several recommended addendums. That is a boatload of fine print. What are the flashpoints in these contracts?

Monty’s Answer: I am unaware of any organization that keeps track of or analyzes the difficulty in communicating or implementing the specific sections of the contracts you mentioned. Contracts create a written conversation between the parties involved to express agreement and make promises about future events that are enforceable by law. Real estate law is complicated. A thorough understanding of the intent and the legal implications of the contract language is the best way to avoid the flashpoints.

Some background information

The real estate association in my home state recently wrote an article for their monthly magazine about the ten trickiest parts of real estate contracts, based on the volume of questions the association’s agent hotline received on specific contract subjects from real estate agents seeking help. They directed the article at the state’s real estate agents as an educational reference.

Using the assumption that if these sections of the contracts generate the highest concentration of questions from real estate agents, that these same contract sections will ultimately create the most angst among real estate consumers. While some agents understand the language, not all real estate agents will take the time to understand a subject better, or will not realize they do not understand the issue.

Additionally, it is logical to assume these sections are dealt with in every states’ law because all states have regulated real estate transactions to guard consumer interests. To best utilize this information, you can perform an internet search for <your state – real estate contract forms>, identify the listing contract and offer to purchase forms, and then locate the sections mentioned below. While issues can develop anywhere in a contract, by focusing on these sections you are most likely covering the flashpoints.

The ten flashpoints

- Agency – The real estate association article described agency this way, “ While tricky to explain, the concept is not impossible.” In my opinion, agency is not the issue in real estate. The real question is competency and honesty.

- Protected buyers and sellers – An agent can “protect” a buyer on a listing contract, and agents can “protect” properties for buyers with buyer agency contracts. The word “protected” refers to the protection of a commission for an agent on an expired listing or unfulfilled buyer agency contract.

- The privacy of a real estate condition report (RECR) – When a transaction fails to close, and the RECR revealed defects, what happens to the RECR? Who can have access to it?

- Offer deadlines – Deadlines are rampant in a real estate transaction. The agent’s job is to keep track of them. How are they calculated? If you miss a deadline, what happens? Alternatively, when they state no deadline in the contract, what happens?

- Fixtures versus personal property – What is the definition of a fixture? What if it is a rented fixture? Is shrubbery a fixture? How is what stays and what goes decided?

- Delivery of the loan commitment – How is it correctly delivered? Who can provide it? What action constitutes a loan commitment? Can it contain contingencies?

- Testing versus an inspection – the differences can be subtle depending on what is being inspected or tested. Knowing the difference between them can prevent misunderstandings.

- Amendment versus notice – Once a purchase agreement is valid buyer and seller communicate with notices and amendments. What is the difference? When to use which form? The circumstances will dictate the proper form, but does your agent know it?

- The dreaded bump clause – When two homes are involved in a transaction, the choices you make in completing the form can foretell a blessing or a burden. Understanding the consequences of your decisions reduces your risk of financial loss.

- When the transaction fails, who gets the earnest money? Does the buyer get the deposit back? Does the deposit come to the seller? Do agents share in a lost deposit?

Most consumers are optimistic that their transaction will close, so the impact of a transaction failing is often minimized. Real estate transactions fail for many reasons. Understanding the legal implications beforehand improves your decision making ability.